SACRRA

Empowering well-informed choices within constantly evolving markets

Facilitating the sharing of credit and risk information to enable our members to make informed credit and risk decisions pertaining to credit and other service applications by consumers

Welcome to the South African Credit and Risk Reporting Association (SACRRA) - Your Personal Partner in Ensuring Fair and Responsible Credit and Risk Decisions

We are a non-for-profit voluntary industry association. Since 1989 we have been facilitating the sharing of credit and risk information to enable our members to make informed credit and risk decisions pertaining to credit and other service applications by consumers. Our legal data sharing prescripts are based on the principle of reciprocity, as a result our members are not only registered credit providers but telecommunication companies, insurers, debt buyers, subscription service providers, credit bureaus, loan system provider and analytical companies.

Through the SACRRA managed Central Data Transmission Hub, our tools and support we enable on a monthly basis, an average 54 million records to be submitted to the current six credit bureaus that have been authorised by the National Credit Regulator to hold payment profile information.

These credit bureaus are:

- Consumer Profile Bureau (CPB)

- Experian

- ITC Credit Bureau

- TransUnion

- VeriCred Credit Bureau (VCCB)

- Xpert Decision Systems (XDS)

Become a Member

Becoming a SACRRA member opens the door to a world of opportunity for your business to access tools and support to comply with the requirements of the National Credit Act (NCA) relating to the sharing and access to consumer profile information.

find out moreWhat Credit and Risk Information does SACRRA Facilitate the Sharing of

SACRRA facilitates the sharing of various types of credit and risk information. This includes consumer credit information, which covers a person’s credit history, financial history, education, employment, career, business history, and identity. SACRRA facilitates the filing of consumer credit information from data contributors in different industry sectors at the six primary credit bureaus’ databases as authorised by the National Credit Regulator.

For example, in the furniture retail sector, data such as revolving credit store cards and rental assets are submitted. In the insurance sector, information on short-term insurance premiums, life insurance, and secured pension or policy-backed lending is shared. Other sectors, like retail apparel and telecommunications, submit data on revolving credit store cards and open services respectively. Additionally, SACRRA facilitates the sharing of data on personal loans, credit cards, home loans, building loans, student loans, and vehicle and asset finance, among other types of accounts.

This comprehensive data sharing allows SACRRA members to have a deeper understanding of their customers and make informed credit and risk decisions

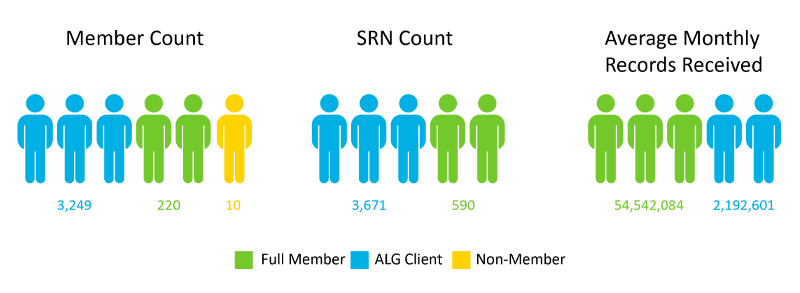

Quick Facts About SACRRA

20 Account Types Being Submitted

0.6% Submission Rejected Rate (Stats: 2022)

Manages Sole & Legally Recognized Central Data Transmission Hub in South Africa

3 349 Members representing 11 Sectors

Daily data submissions (opened and closed accounts) within 48 hours.

Average of 54.5 Million Records Submitted to 6 Accredited Bureaus.

Credit Bureau Dispute Process

Facing a dispute? Wondering what steps to take next? Here’s your guide for navigating credit disputes, complete with valuable information and helpful links.

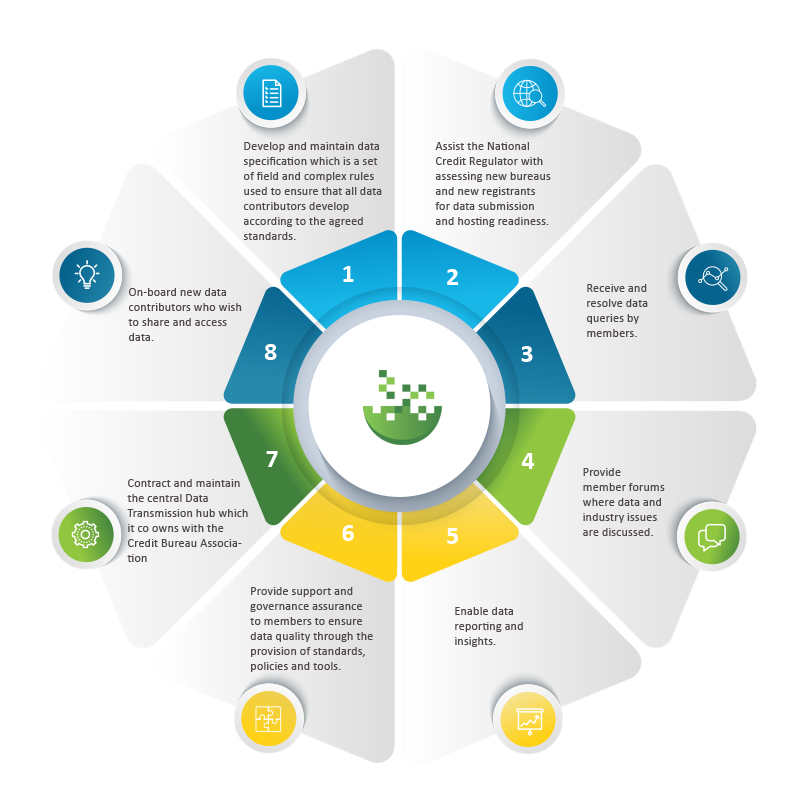

How Can We Assist?

Introducing SACRRA – your key to unlocking the power of shared data for informed credit and risk decisions!

Membership

Becoming a SACRRA member opens the door to a world of opportunity for your business to access tools and support to comply with the requirements of the National Credit Act (NCA) relating to the sharing and access to consumer profile information.

Consumer

A lot of us know that Credit Bureaus collect and share information with credit and other service providers. What we do not know is how that information gets to the six primary Credit Bureaus in South Africa, that are approved to hold consumer profile information.

Initiatives & Tools

While funds may be available, obtaining the required finance often proves difficult, predominantly due to insufficient information on businesses for credit providers to evaluate affordability and creditworthiness.

How Does Credit and Risk Information Flow in South Africa?

Regulation (19) 13 Requirements

3.1 All credit providers must utilise the Data Transmission Hub for the submission of all credit information in accordance with Annexure A and information pertaining to the removal of adverse information to the credit bureaux.

3.2 All credit providers must utilise the data format for purposes of the submission and updating of credit information to the credit bureaux.

3.3 All data providers that access the payment profile information of a consumer for a permitted or prescribed purpose as provided for in the Act must:

3.3.1 provide all relevant credit information in respect of consumers to credit bureaux in the same manner and form as credit providers in order to receive payment profile information from a credit bureau in respect of any consumer;

3.3.2 ensure that they comply with all the requirements set out in the Act for loading credit information onto the credit bureaux;

3.3.3 utilise the Data Transmission Hub for the submission of credit information to the credit bureaux and in doing so, must use the data format for purposes of such submission; and

3.3.4 pay any fees that are prescribed for the onboarding, usage and maintenance of the Data Transmission Hub.

4.1 The details of all new credit agreements entered into with consumers within 48 (forty-eight) hours of the credit agreements being concluded;

4.2 The details of all closed, terminated, rescinded or settled credit agreements within 48 (forty-eight) hours of the credit agreements being closed, terminated or settled;

4.3 The monthly payment profile information of consumers within 5 (five) business days of the agreed billing cycle;

4.4 Subject to the provisions of Regulation 19 (4) and Regulation 19 (7), the adverse classifications of consumer behaviour and adverse classifications of enforcement actions on a monthly basis; and

4.5 The submission of all adverse information and judgment debts as set out in S71A (1) (a) to (d) of the Act within 7 (seven) days of such settlement by the consumer.