SACRRA

Awareness of your data rights and responsibilities

What Role Does SACRRA Play In The Sharing of Consumer Credit & Risk Information In South Africa?

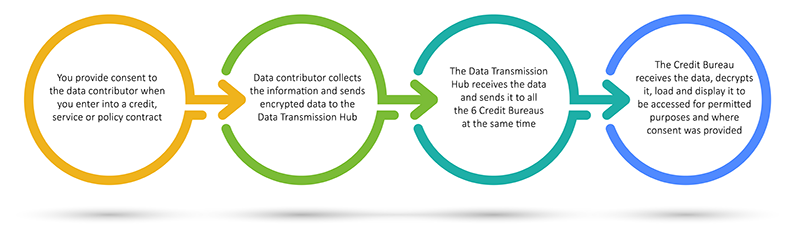

A lot of us know that Credit Bureaus collect and share information with credit and other service providers. What we do not know is how that information gets to the six primary Credit Bureaus in South Africa, that are approved to hold consumer profile information. SACRRA plays a crucial role in making sure that data is submitted on time, is correct and up to date. SACRRA manages the central system in South Africa through which credit and risk information is submitted to the Bureaus. This system is called the Data Transmission Hub (DTH). The DTH processes an average of 58.4 million records on a monthly basis.

Data contributors, who are members of SACRRA, comprise of credit providers, insurers, cell phone providers, subscription service providers and debt buyers. SACRRA does not hold or process the information but ensures that all data contributors comply with industry and regulatory requirements relating to the quality of the data submitted, the timeframes within which data must be submitted and removed as well as the continuous updating of the data at the Bureaus.

In simple terms the graph below shows how the data flows from the DTH to the Bureaus:

What type of information are data contributors transmitting through the data transmission hub?

Any consumer who has entered into a credit agreement or any other service, insurance or subscription agreement will have certain details relating to that account displayed at the Bureaus. For example, if you have a policy or a cellphone account, your provider is by law required to share the information because they want to access consumer credit profile information to decide whether they will grant you credit or a cell phone contract. Insurers may want to access the information to determine your risk profile. It is important that you understand what information the service provider will share about you when you sign your contract in order to avoid unnecessary lodging a dispute with the Bureaus or your service provider.

Below is the type of account information that is passed through the Data Transmission Hub:

Below is the type of account information that is passed through the Data Transmission Hub:

Questions And Answers . .

- Credit Providers

- Insurers

- Telecoms

- Debt Recovery

Type of Data Contributor

Impact on a credit score

- Type of credit agreement you have entered into

- The status of the account

- Your monthly payment behaviour

- Any adverse actions they have taken and their outcomes if you defaulted

- This is the information that impacts your credit score mostly as many scores factor in the following information:

- How much debt you have compared to your income and expenses

- How much your monthly instalments are

- How you are conducting your account in terms of payment

- If you have any adverse listings or judgments

- It is important to keep your payment up to date and consult your creditors if you are struggling to meet your monthly obligations

Type of Data Contributor

Impact on a credit score

- For Short- and Long-Term Policy premiums only

- Status of the account like Lapsed or Cancelled by you or the insurer

- Ensure that premiums are up to date as some creditors may consider premium arrears as an indicator of future bad payment behaviour

- There are no negative consequences on your score if you cancel your policy but you do need to consult a financial advisor to make sure you make an informed choice

Type of Data Contributor

Impact on a credit score

- Service type accounts which do not have a credit limit but where the total expenditure in the previous month is expected to be paid in full after each cycle

- The installment due and any arrears

- Avoid being in arrears with any of your service accounts as arrears will reflect on your payment profile and where the debt is handed over, there will be an adverse listing or a judgment

Type of Data Contributor

Impact on a credit score

- Where an account has previously written off and is now in the collections environment

- Same as Credit Providers

- Ensure that you stick to the new payment arrangement as any default can lead to further legal action

- Once you have settled the account, ensure that you are provided with a paid-up letter which you must submit to the Bureau for your profile to be updated or any adverse listing or judgment to be removed

What Type of personal information are credit bureaus allowed to keep and share?

Section 70 of the National Credit Act provides that Credit Bureaus can hold and share the following information about you:

- Your credit history, including applications for credit.

- Credit agreements you have signed.

- Your monthly pattern of payment which is called your monthly payment profile.

- Any arrears or defaults recorded.

- Whether you are under debt counselling, administration of have been sequestrated.

- Any enforcement actions taken by your creditors if you fail to pay according to the agreed amounts and times.

- Your financial history, including your past and current income.

- Assets and debts, and other matters within the scope of your financial means, prospects and obligations, such as

- Your education, employment, career, professional or business history, including the circumstances of termination of any employment, career, professional or business relationship, and related matters; or

- Your identity, including your name, date of birth, identity number, marital status and family relationships, past and current addresses and other contact details, and related matters.

What is the responsibility of the credit bureau in marketing my information?

A Credit Bureau is required by law to:

- take reasonable steps to verify the accuracy of any consumer credit information reported to it;

- accept the filing of consumer credit information from any credit provider on payment of the credit bureau’s filing fee, if any;

- accept without charge the filing of consumer credit information from the consumer concerned for the purpose of correcting or challenging information otherwise held by that Credit Bureau concerning that consumer;

- not draw a negative inference about, or issue a negative assessment of, a person’s creditworthiness merely on the basis that the Credit Bureau has no consumer credit information concerning that person; and

- not knowingly or negligently provide a report to any person containing inaccurate information.

How does data flow and get updates and displayed?

A Credit Bureau is required by law to:

Monthly and daily files are extracted and submitted to the bureaus in accordance with timelines and/or an event.

A monthly file is a “snapshot” of a customer’s account or record as at the month-end or agreed billing date (the same information that would be on a statement for the account) and a daily file is submitted for accounts opened and closed daily.

The credit bureaus will receive the files through the Data Transmission Hub. Once the file has passed all the validation rules and the bureau is satisfied to load the data, it is matched to a consumer’s record and updated under the payment profile section. The data reflects the position of the account as at the current month, as well as an indication of how the account has been paid over the past 24 months, for example:

A record submitted in a monthly file will be diplayed a follows:

| ABC Loans | |

| Date Account Opened | YYYY-MM-DD |

| Type of Account | Personal Loan |

| Account Number | 12345678910 |

| Open Balance / Credit limit | R 10 000 |

| Current Balance | R 4 600 |

| Instalment Amount | R 200 |

| Arrears Amount | R 0 |

| Status of the Account | Active |

| Date Last Payment | YYYY-MM-DD |

The bureau keeps the history and displays how the account has been paid over the last 24 months as reflected below, where 0 = current, 1 = 1 month in arrears etc.:

How long does information about me remain displayed at the bureaus?

Below are the legal timeframes that stipulate how long information should sit at the Bureaus. It is important to note that while information might automatically be removed after the specific timeframe, the debt remains due and payable unless it has been prescribed.

Categories of Consumer Credit Information

Description

Timeframe

Details and results of complaints lodged by consumers

Number and nature of complaints lodged and whether a complaint was rejected. No information may be displayed on complaints that were upheld

6 months

Enquiries

Number of enquiries made on a consumers record, including the name of the entity/person who made the enquiry and a contact person if available

1 year

Payment Profile

Factual information pertaining to the payment profile of the consumer

5 years

Adverse classifications of enforcement action

Classification related to enforcement action taken by a credit provider

1 year or within the period prescribed in section 71A

Adverse classifications of consumer behaviour

Subjective classifications of consumer behaviour

1 year or within the period prescribed in section 71A

Debt Restructuring

As per section 86 of the Act, an order given by the court or Tribunal

Within the period prescribed in section 71(1) of the Act or until a clearance certificate is issued

Civil court judgments

Civil court judgments including default judgments

The earlier of 5 years or until the judgment is rescinded by the court or abandoned by the credit provider in terms of section 86 of the Magistrates Court Act 32 of 1944 or within the period prescribed in section 71A of the Act

Maintenance judgments in terms of the Maintenance Act 99 of 1998

As per the court judgment

Until the judgment is rescinded by a court

Administration Order

As per court order

5 years or until order is rescinded by court

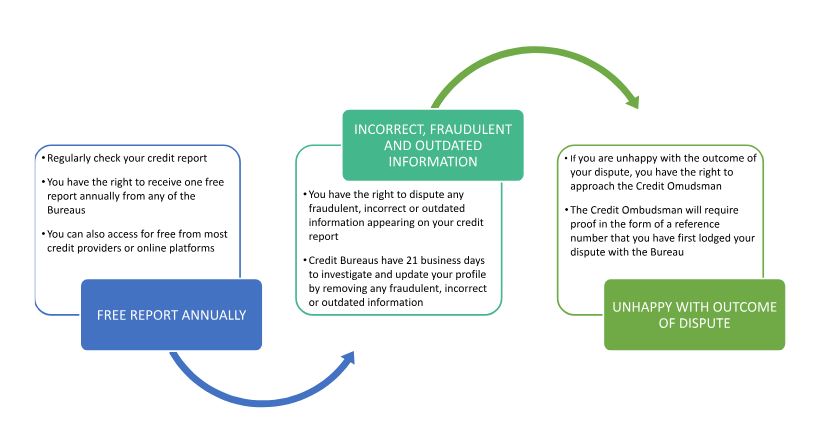

How Do I Dispute Fraudulent, Incorrect or Outdated Information On My Report?

- Section 72 (1) (c) of the National Credit Act states that every person has a right to challenge the accuracy of information held at the Credit Bureau.

- If a person has challenged the accuracy of information, the Credit Bureau to whom the challenge has been made must take reasonable steps to seek evidence in support of the challenged information, and within 20 business days must:

- provide a copy of any such credible evidence to the person who filed the challenge, or

- remove the information, and all record of it, from its files, if it is unable to find credible evidence in support of the information.

How to Read My Credit Report

The Guideline issued in terms of Regulation 19(13) describes the type of information that should be submitted to the bureaus. The overarching descriptors will assist you to understand some of the information that appears on your bureau report.